According to a market report from China “global mobile phone image sensor market is declining, and it is recommended to deploy multi-level product lines, combined with production capacity advantages, to impact market share.” [English translation]

In the first quarter of 2022, the global mobile phone image sensor shipments will be approximately 1.13 billion units, a year-on-year decrease of approximately 27.0%.

Market demand in Europe and mainland China has suffered multiple blows, and the Latin America market may be able to stand out

The upgrade of pixel specifications shows polarization, “main camera up, sub camera down”

Leading manufacturers will use production capacity advantages to control supply or change the adversity, and local manufacturers will seek opportunities through differentiation

Suggestion: Improve product functional value, upgrade product structure, and be cautious in large-scale expansion

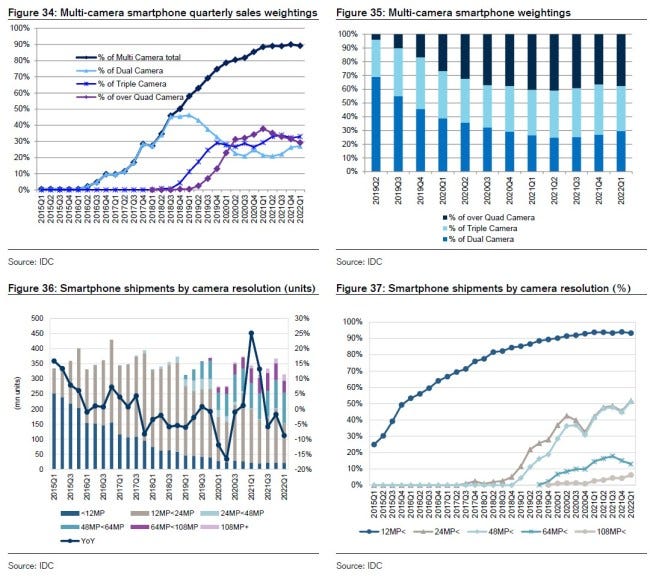

A recent report by TrendForce forecasts that the relative share of quad-camera module market will not grow much between 2021 and 2022. One explanation might be that there is diminishing returns beyond a certain number of cameras and smartphone companies are focusing on algorithmic enhancements to image/video quality which may give similar results.

TrendForce indicates that mobile phone brands are currently curtailing competition in the hardware specifications of mobile phone camera modules but remain focused on photographic and video performance as promotional features of their mobile phones and will emphasize dynamic photography, night photography and other scenarios to highlight product advantages. This can be achieved not only by strengthening the optical performance of the camera module itself but also through algorithms and software, thereby increasing the enthusiasm of mobile phone brands to invest in self-developed chips.

Capacity utilization has fallen to 20–30% at Samsung’s CIS production line. Related capex has reportedly dropped to near zero, except for some 100MP / 200MP production and the basic line maintenance. There are reportedly no prospects of production recovering in 2022. The CIS production slump at Samsung is attributable to (1) quality issues in the Chinese market, and (2) loss of market share due to Chinese customers switching to Sony. With the inventory correction also affecting image signal processors (ISPs) and other LSI chips that form CIS attachments, chip foundries are maintaining production at full capacity by investing more in display driver ICs (DDIs).(Credit Suisse report)

The ratio of multicamera smartphones fell 1ppt QoQ in Jan–Mar 2022 to 89%. This included modest QoQ declines for triple- and quad-camera models. While the increasing quad-camera ratio is rising for premium models priced at USD1,000 or higher, low-end and mid-range phones are shifting from triple to dual cameras. In pixel density, the proportion of phones with 48MP and larger cameras rose both YoY and QoQ. In particular, the low-end to USD1,000 range saw an increased weighting of 48–64MP cameras. High-end models in the USD600–1,000 range conversely saw a decreased weighting of 64MP and over. Premium models priced at over $1,000 had increases for both 48–64MP and 108MP. (Credit Suisse report)