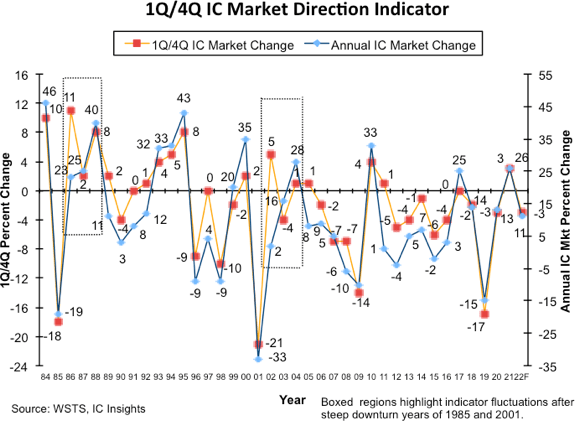

According to IC Insights, in 1984–2020, the average seasonal sequential decline in the 1Q/4Q IC market was 2%. In 1Q20, the IC market was down 3% compared to 4Q19, slightly below the historical average. The 1Q21/4Q20 IC market change of 3% was much better than the 1Q20/4Q19 IC market change of -3%. As a result, IC Insights believes that the full-year annual growth rate for the 2021 IC market will likely be much better (26%) than the 13% increase the IC market registered in 2020. Conversely, since the 1Q22 / 4Q21 IC market is forecast to be down 3%, the IC market direction indicator depicts the 2022 IC market growing much less than it did in 2021 (11% in 2022 versus 26% in 2021). If 1Q22 / 4Q21 IC market growth surprises to the upside of -3%, an upgrade to their current 11% forecast for 2022 may be warranted. (CN Beta, IC Insights)

IonQ, a leader in quantum computing, has announced that it plans to use barium ions as qubits in its systems, bringing about a wave of advantages it believes will enable advanced quantum computing architectures. IonQ is the first quantum computing company able to harness more than one atomic species as qubits, having built its systems to date with ytterbium ions. Now, IonQ plans to use barium ions to build systems that are designed to be faster, more powerful, more easily interconnected, and that feature more uptime for customers. (CN Beta, Yahoo, HPC Wire)

Stellantis has unveiled a nonbinding accord with Foxconn owner Hon Hai Technology Group for the design of 4 new families of automotive chips. By sidestepping traditional partsmakers and dealing directly with the chip manufacturer, the company CEO Carlos Tavares has said the pact will cover more than 80% of the automaker’s needs. The preliminary agreement with Foxconn calls for the chips to be available for use in vehicles in 2024, helping to stabilize the supply chain. (CN Beta, Bloomberg, Auto News)

Intel has discontinued their Comet Lake-U, Ice Lake-U, and Lakefield laptop CPUs earlier 2021. Now, Intel is initiating their End-Of-Life (EOL) plan for the higher-end mobile 14nm Gen Core CPUs, which happens to be the remainder of the Comet Lake series. Customers will be able to order the processors until 1H22. It is speculated that it is due to the fact of two 10nm processors by Intel are still on the market being more favorable than the 14nm chipset. (CN Beta, Tom’s Hardware, WCCFTech)

Samsung believes the chip shortage will continue to affect its smartphone operation up to 2H22. Supply of AP and RF chips will be tight up to 2H22. Samsung Mobile also believes the shortage in production capacities by foundry companies (companies that contract manufactures chips designed by their customers) to continue. Fabless companies (companies that design chips but do not manufacture them, such as Qualcomm) will therefore focus on supplying products with high margins first. Samsung Mobile will seek annual contracts to secure production capacities from foundries beforehand to minimize the impact of these trends. (Gizmo China, The Elec)