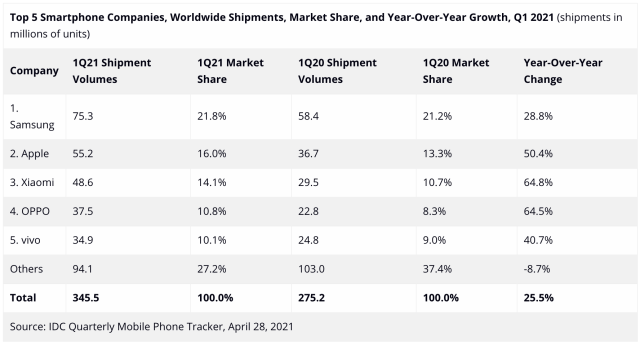

The pace of recovery for the smartphone market accelerated in 1Q21 with 25.5% YoY shipment growth. According to IDC, smartphone vendors shipped nearly 346M smartphones during 1Q21. Samsung regained the top spot in 1Q21 with impressive shipments of 75.3M and 21.8% share. The new S21 series did well for Samsung, mainly thanks to a successful pricing strategy shaving off USD200 from the flagship launch in 2020. (CN Beta, IDC)

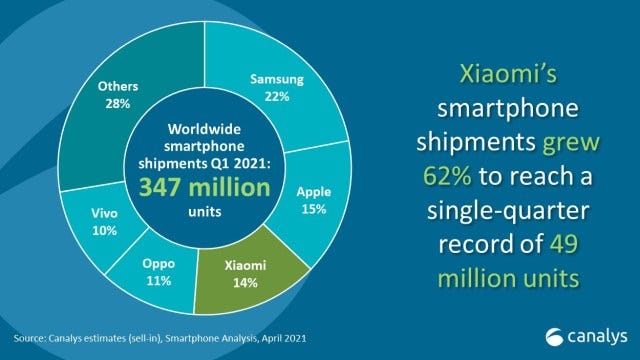

In 1Q21, worldwide smartphone shipments reached 347M units, up 27% YoY. Samsung took first place, shipping 76.5M to take a 22% share. Apple shipped 52.4M iPhones, to take a 15% share. Xiaomi clocked its best single-quarter performance ever, growing 62% and shipping 49.0M units. (Canalys, GSM Arena)

According to Strategy Analytics, China’s rapid adoption of 5G technology is powering demand for 5G smartphones. Apple and the domestic trio of OPPO, vivo and Xiaomi benefitted most as the demand exploded. OPPO, Vivo and Xiaomi closed on Apple capturing 16%, 14% and 12% global market share in 1Q21, respectively. (Android Authority, CN Beta, Strategy Analytics)

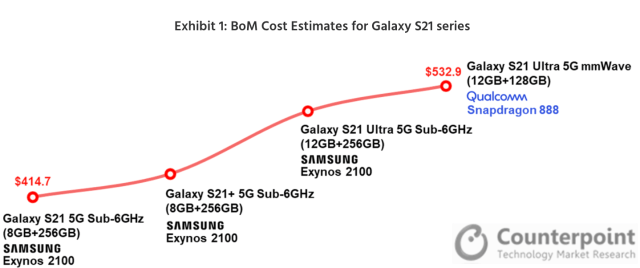

Producing Samsung’s 128GB Galaxy S21 Ultra mmWave smartphone costs Samsung up to USD533, around 7% less compared to the Galaxy S20 Ultra 5G, according to the latest bill of materials (BoM) analysis by Counterpoint Research. The Galaxy S21 series has an optimized cost structure with the models’ cost USD400–600. (Phone Arena, Counterpoint Research)

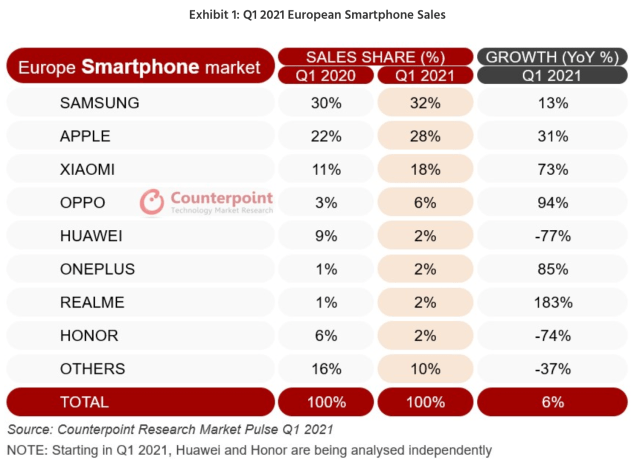

According to Counterpoint Research, an improving COVID-19 outlook compared to this time in 2020 (the end of 1Q20 marked the beginning of a major downturn for the smartphone market as the pandemic started to take its toll), helped European smartphone sales grow by 6% annually in 1Q21. (Phone Arena, NokiaMob, Counterpoint Research)

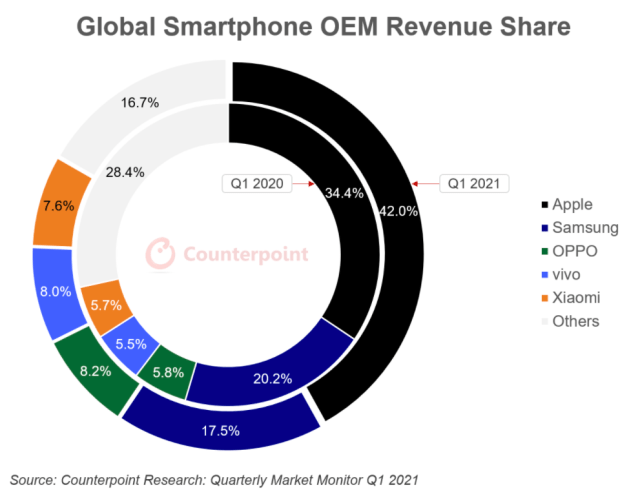

According to Counterpoint Research, global smartphone segment clocked a record 1Q21 wholesale shipment revenues of USD113B, up 35% YoY. Apple captured a record 1Q21 revenue share driven by the strong performance of the iPhone 12 Series and demand spill-over from the previous quarter due to delayed launch. (Counterpoint Research)

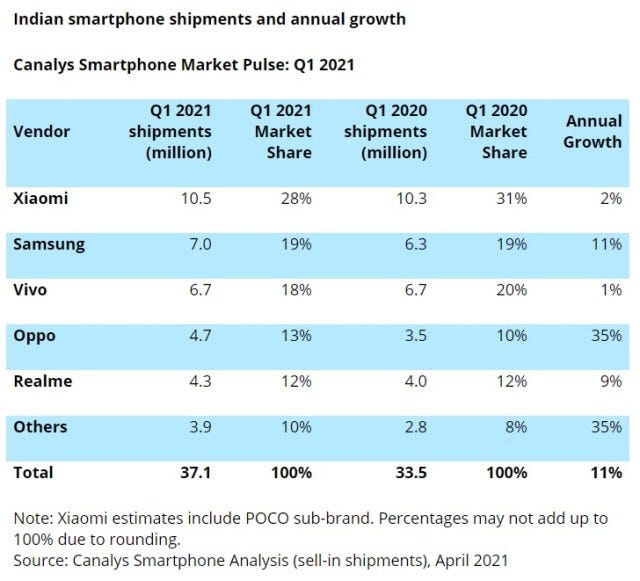

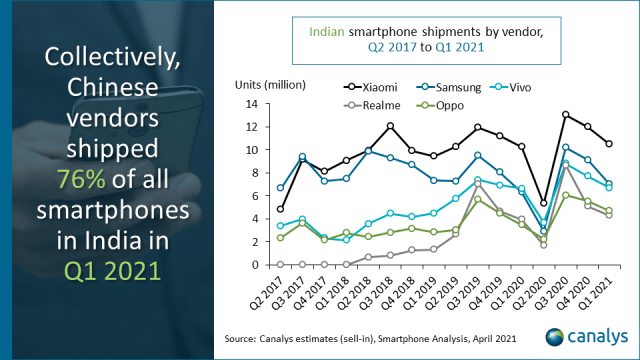

According to Canalys, smartphone shipments in India grew 11% in 1Q21, to 37.1M units, as favorable macroeconomic factors helped smartphone vendors capitalize on the growing importance of smartphones for remote education for Generation Z and for work and leisure for Millennials. Xiaomi retained its position as the market leader, with its 10.5M shipments accounting for a 28% share. (Laoyaoba, Canalys)