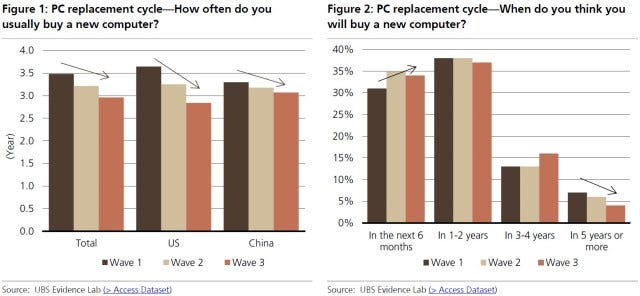

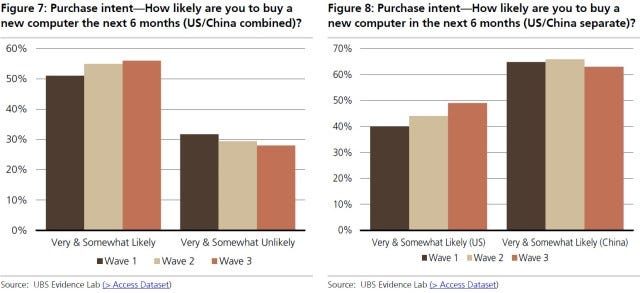

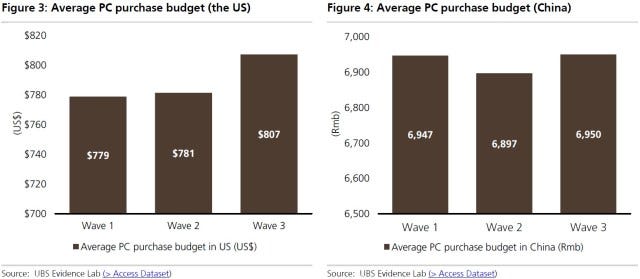

In Feb 2021, UBS Evidence Lab completed its latest semi-annual proprietary global PC consumer survey of 1,500 PC owners in the US and China, providing a timely update to gauge consumer PC demand amid Covid-19. The key findings are: 1) the consumer PC replacement cycles appear to be shortening from 3.5 years in Feb 2020 to ❤ years in Feb 2021, 2) PC budgets increased, especially in the US, 3) a strong improvement in PC purchase intent in US, and 4) PC usage for gaming increased substantially, which bodes well for companies geared towards gaming. Although ~70% consumers said they would consider pushing out PC purchases due to Covid-19, UBS believes positive survey results could offset the concerns. In addition, they are cautious about a potential demand cool-down after Covid-19 vaccines prevail, starting in 2H21 and 2022. (UBS report)

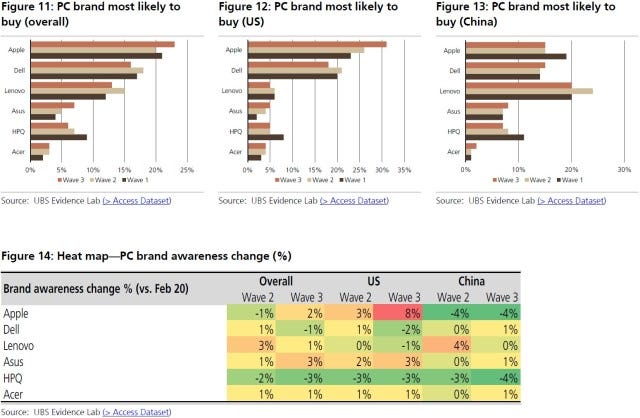

UBS Evidence Lab’s survey results showed Apple is the most-preferred PC brand (23% of total respondents in China and the US were most likely to purchase this as their next PC), followed by Dell (16%) and Lenovo (13%). In China, the survey results indicate Lenovo’s brand recognition is decreasing with only 20% of respondents intending to buy a Lenovo PC, down from 25% in Jun 2020. (UBS report)

Based on the positive survey results, UBS believes strong global PC demand could continue into 1H21 or possibly 2H21. Adjusting their 2020 PC shipment forecasts to actual shipments, they raise our global PC shipments (including Chromebooks) by 14.4% / 8.7% for 2021 / 2022 to reflect the stronger-than-expected demand. UBS now projects 2021 global PC shipments including Chromebooks to rise 5.3% YoY after 10.7% YoY growth in 2020. They project 2021 global notebook shipments to reach 209.5M units, up 5.8% YoY (versus 22.1% YoY in 2020), Chromebook shipments to increase around 30% to 40M units, and desktop shipments to continue to decline (-5.2% in 2021 to 75.8M) after 2020’s -20.4% YoY decline. (UBS report)