Automotive Semiconductor

According to Gasgoo’s data, since 2015, the value of ICE (traditional internal combustion engine vehicles) semiconductor bicycles has increased by 23%, from USD338 to USD417. New energy and intelligence also bring new incremental opportunities, including power semiconductors for electric power systems, power management systems, MCUs for body electronic management systems, as well as intelligent sensors and ASICs. In 2019, the value of MHEV (light hybrid electric vehicle) semiconductors is USD531, PHEV (plug-in hybrid electric vehicle) is USD785, and BEV (pure electric vehicle) is USD775. According to Foresight Industry Research Institute, the global automotive semiconductor market in 2019 is USD46.5B. In 2020, due to the impact of the epidemic on global automotive sales, the automotive semiconductor market will slightly decrease to USD46B. (CITIC Securities report)

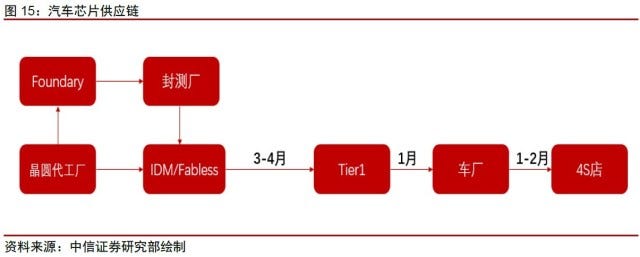

In the entire chip supply cycle, it usually takes 3–4 months for Tier-1 car vendors to receive chipsets from the upstream supplier; about 1 month for Tier-1 vendor to assembly the car components with the chipsets and deliver to the car manufacturers; about 1–2 months for car manufacturers to make the cars and deliver to the 4S shops. This implies that car chip manufacturers need to schedule production 5–6 months earlier than vehicle shipments. Therefore, once the car company makes a mistake in judging the future market demand, it will disrupt the rhythm of the upstream supply chain in a few quarters. (CITIC Securities report)

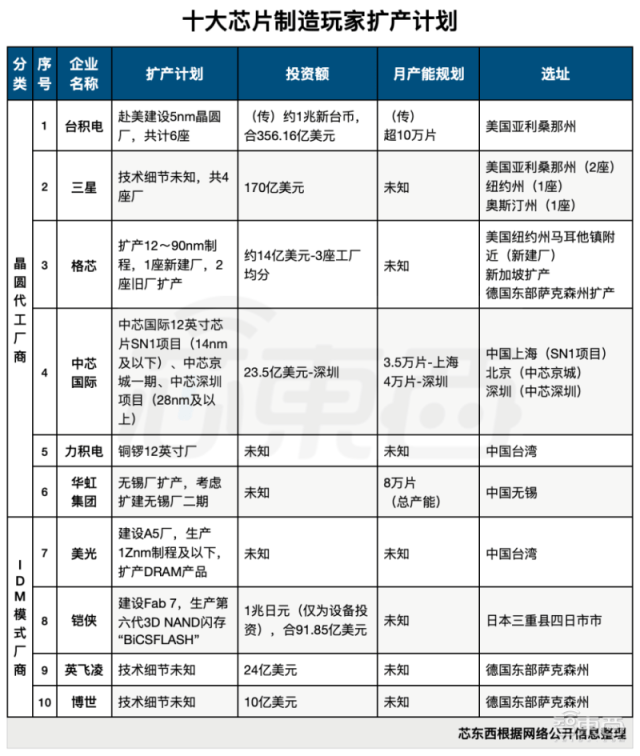

Semiconductor Top 10

SMIC has announced that it will launch a 12” wafer production project with a 28nm and above process through SMIC Shenzhen, and plans to start production in 2022. The planned monthly production capacity of the new fab is 40,000 pieces, which is 5,000 pieces more than the planned monthly production capacity of SMIC’s 12” production project in Shanghai. (CN Beta, 36Kr, Xindongxi)

Samsung Electronics faces a loss of over KRW400B (USD353.4M) as its first-ever shutdown at fab in Texas stretches to more than a month after a power outage from an unusual cold snap in the warm state, causing interruption in its global chip supplies for IT devices. Meanwhile, NXP Semiconductors has estimated the production halt has cut its 2Q21 sales by about USD100M. (Pulse News, Laoyaoba)