- Global

Global smartphone shipments are likely to grow nearly 50% on year to 340M units in 1Q21, driven by robust sales of Apple’s iPhone 12 Pro and iPhone Pro Max as well as a ramp-up in shipments by Chinese brands to grab the market share relinquished by Huawei, according to Digitimes Research. Global shipments of 5G-enabled phones are expected to reach over 600M units in 2021 compared to 280M units shipped a year earlier, Digitimes Research estimates. Huawei, Apple and Samsung were the top-three 5G phone vendors in 2020, accounting for over 70% of global 5G phone shipments. (Digitimes, press, Sina)

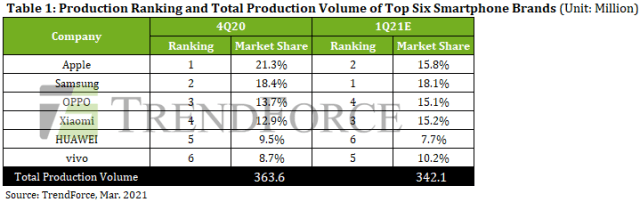

Owing to high sales of the iPhone 12 series as well as an aggressive device production strategy by Chinese smartphone brands in response to sanctions on Huawei, which has lost considerable market share as a result, global smartphone production for 1Q21 is likely to reach 342M units, a YoY increase of 25% and a QoQ decline of just 6%, according to TrendForce. Historically, smartphone production tends to experience a QoQ drop of around 20% for 1Q21 as demand collapses from the peak-season level of 4Q20. Apple produced 77.6M units of iPhones in 4Q20, an 85% increase QoQ, thereby overtaking Samsung and ranking first amongst all smartphone brands. It should also be pointed out that iPhone 12 devices accounted for about 90% of the iPhone production in 4Q20. (GSM Arena, TrendForce, TrendForce)

According to Omdia, Apple iPhone 11 was the most shipped smartphone in 2020 with 64.8M units in shipments and USD754 ASP (Average Selling Price). Its predecessor (iPhone XR) topped the list in 2019 but the units were less at 46.3M and the ASP was a bit more at USD777. Further, the second, third, seventh, and tenth positions were also occupied by Apple with the 2020 iPhone SE (24.2M), iPhone 12 (23.3M), iPhone 12 Pro Max (16.8M), and iPhone 12 Mini (14.8M). (Laoyaoba, Gizmo China, CN Beta, Phone Arena)

2. China

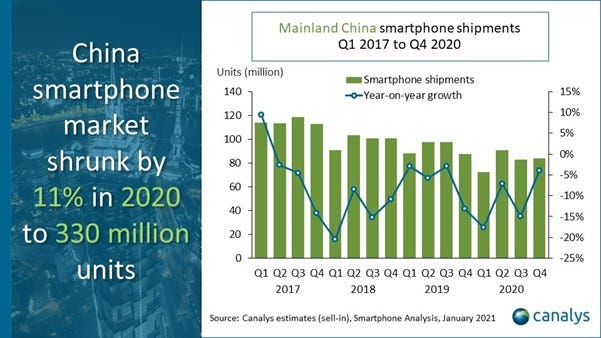

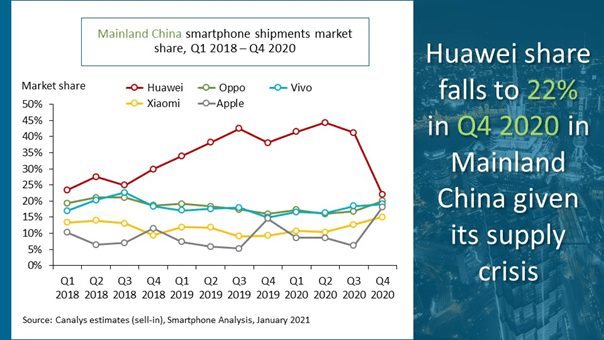

The smartphone market in Mainland China finished 2020 with 84M units shipped in 4Q20, declining 4% YoY. That meant for the full year, the China market declined 11% to arrive at just over 330M units, as market recovery was stalled by the rapid deterioration of Huawei’s performance as a result of US sanctions. For 4Q20, Huawei (including Honor) managed to ship 18.8M units, and its market share declined to 22% from 41% in 3Q20. OPPO rose rapidly into second place, shipping 17.2M smartphones, growing 23% YoY. (CN Beta, Canalys)

3. EMEA

IDC reports the EMEA market volume in 2020 contracted 4.2% in units YoY, dropping to a total of 345.2M. The market’s value likewise declined, by 4.6% YoY, to around USD110B. In Europe, IDC has found that the market suffered a 4.9% slump YoY in unit terms, falling to 195.2M. The market lost 3.0% in value YoY, declining to USD82.4M. (CN Beta, IDC)

4. LATAM

LATAM smartphone shipments dropped 10.3% YoY in 4Q20 but increased 9.7% QoQ driven by a recovery from the pandemic and partly due to seasonality, according to Counterpoint Research. For the first time, Xiaomi emerged as the third biggest player in the region in 4Q20. The average selling price (ASP) in the region decreased by 6.4% during the quarter. Samsung remained the region’s absolute leader in 2020 with 40.5% share. In fact, it was leading in all LATAM countries during 2020. Motorola, which is a comfortable second in the LATAM market, increased its share by 3% points. (GizChina, Counterpoint Research)

5. Apple Phone

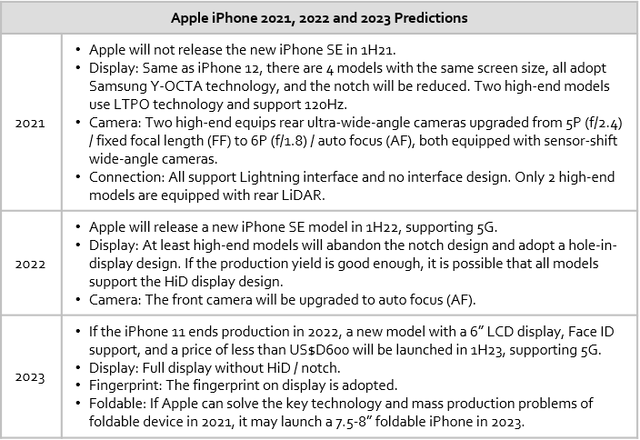

Tianfeng Securities analyst Ming-Chi Guo has made a series of forecasts for Apple iPhone in 2021, 2022 and 2023. He believes that the growth momentum of iPhone in 2021 will mainly come from the increased demand for replacement of 5G, the growth of high-end market share due to the Huawei ban and the price reduction of iPhone 11. It is predicted that iPhone shipments in 2021 will grow 15–20% YoY to approximately 230M units. (TF Securities, CN Beta, CN Beta, GSM Arena, GSM Arena)

Apple is allegedly preparing to move 7%-10% of production for the iPhone 12 from China to India with assembly partner Foxconn said to be working on units for sale within the country and for the export market. A facility in Tamil Nadu will allegedly expand its existing production of the other 2 models to include the current-generation models. (GizChina, My Drivers, Apple Insider, Business Standard, India Times)

6. Wearable and Apple Watch

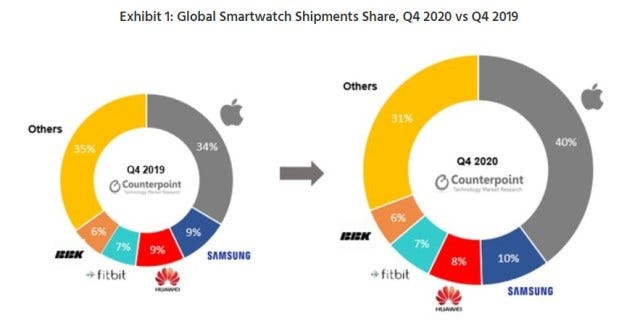

Impacted by the COVID-19 pandemic, global smartwatch shipments in 4Q20 saw a slight YoY decrease to book an almost flat 2020, according to Counterpoint Research. In a year where annual growth inched forward at only 1.5%, Apple maintained its solid number one position and increased its market share by 6p.p., helping shift the overall market closer to the premium segment. The Apple Watch Series 6 and SE did well, shipping 12.9M units and accounting for 40% market share in 4Q20. (Laoyaoba, Counterpoint Research)

7. Apple AR

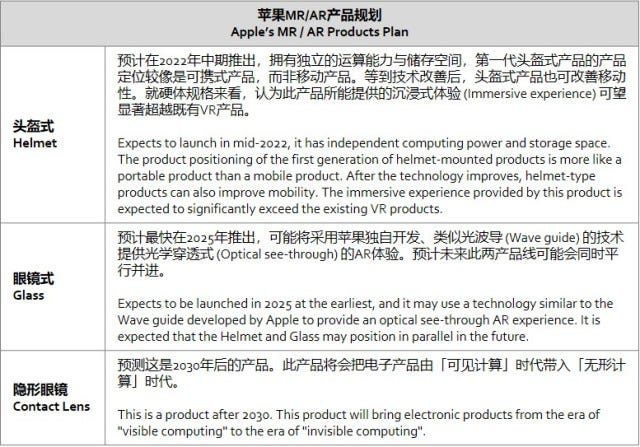

TF Securities analyst Ming-Chi Kuo expects Apple plans to release its mixed reality (MR) headset “in mid-2022”, augmented reality (AR) glasses by 2025, and AR contact lenses in the 2030s. (TF Securities, Mac Rumors, Mac Rumors, The Information)