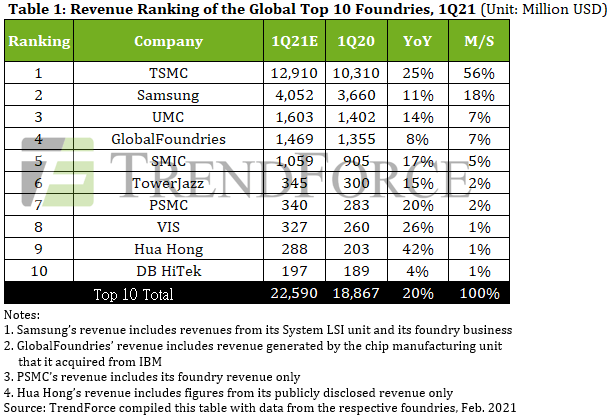

TrendForce expects foundries to continue posting strong financial performances in 1Q21, with a 20% YoY growth in the combined revenues of the top 10 foundries, while TSMC, Samsung, and UMC rank as the top 3 in terms of market share. However, the future reallocation of foundry capacities still remains to be seen, since the industry-wide effort to accelerate the production of automotive chips may indirectly impair the production and lead times of chips for consumer electronics and industrial applications. (TrendForce, TrendForce)

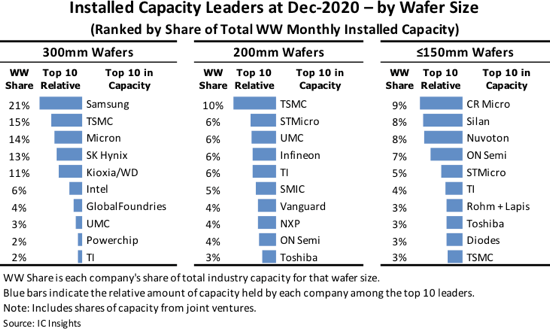

According to IC Insights, as of Dec 2020, only TSMC — the world’s largest foundry — was listed among the wafer capacity leaders in each of the 3 wafer size categories. It had the most 200mm wafer capacity last year and ranked second, trailing only Samsung, in 300mm wafer capacity. (Laoyaoba, IC Insights)

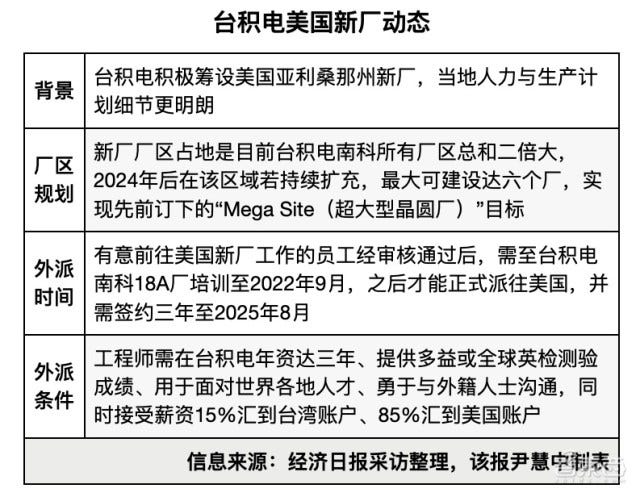

TSMC reportedly plans to build a total of 6 5nm plants in Arizona. These plants’ size is about twice the size of the plant TSMC’s Nanke plant, one of its “base camps”. TSMC’s Arizona wafer fab investment may rise to NTD1T (USD36.2B). Its total monthly production capacity will exceed 100,000 wafers. (GizChina, IT Home, LTN, UDN)