Shipments of smartphone-use application processors (AP) to China, including those for handset exports, will stay flat sequentially in 1Q21, according to Digitimes Research. Shipments compared to a year earlier will register a robust 57% increase. Tight capacity at 8” and 12” foundries is one of the factors driving brand smartphone companies to keenly build up inventories. About 211.6M smartphone APs were shipped to Chinese brand vendors in 4Q20, rising 9.9% on quarter and 7.7% on year. (Digitimes, press, Gizmo China, Digitimes)

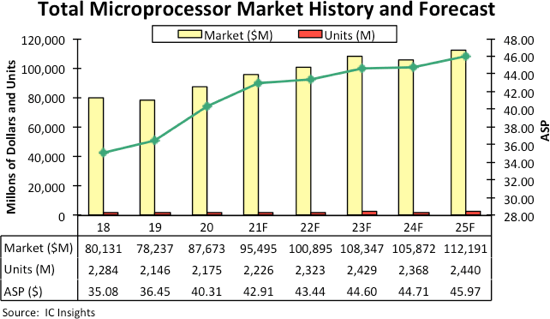

According to IC Insights, sales growth in the total microprocessor market climbed 12% in 2020 to reach a record-high USD87.7B. In 2021, total MPU market growth is forecast to ease back slightly and register an above-average 9% increase to about USD95.5B. In the 2020–2025 forecast period, total microprocessor sales are projected to grow by a CAGR of 5.1% with the only annual decrease occurring in 2024 (-2%), which is expected to be a global economic slowdown year. (IC Insights, Laoyaoba)

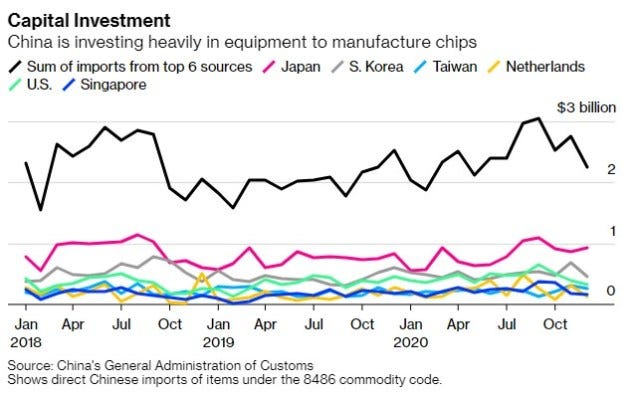

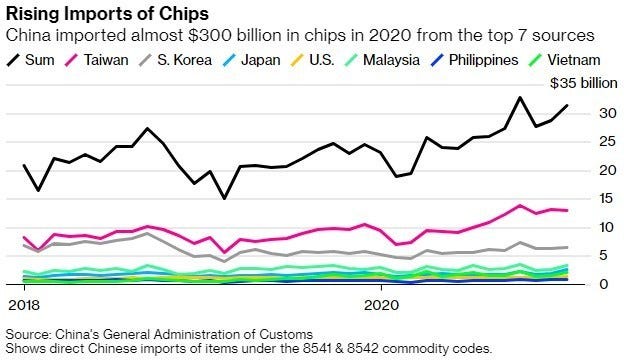

Chinese businesses have bought almost USD32B of equipment used to produce computer chips from Japan, South Korea, Taiwan and elsewhere, a 20% jump from 2019. With companies like Huawei stockpiling supplies ahead of U.S. sanctions, imports of computer chips climbed to almost USD380B — making up about 18% of all of China’s imports for the year. According to SEMI, China became the largest market for such equipment in 2020. (Bloomberg, Gizmo China, My Drivers, SEMI)

credit