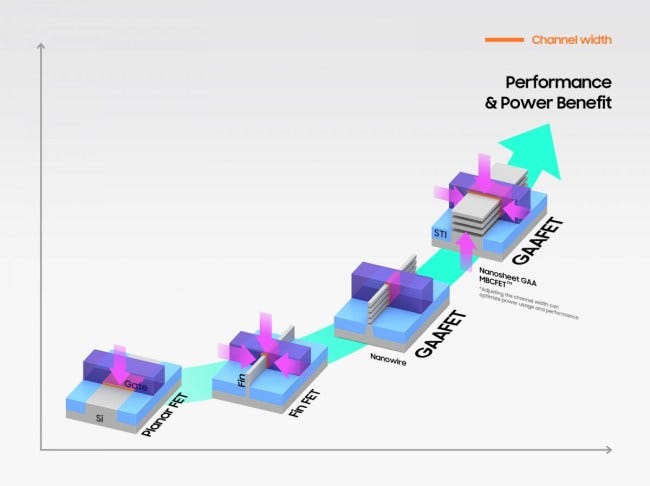

Samsung Electronics has already started the development of a 2nm chipset as competition with Apple and TSMC heats up. Samsung has said it would mass-produce the 2nm process for mobile applications in 2025. The process is claimed to showcase a 12% increase in performance, a 25% increase in power efficiency, and a 5% decrease in total area. Samsung began the 2nm AP (application processor) project codenamed “Thetis”, which is believed to be the Exynos 2600 — the flagship chipset likely to debut with the Galaxy S26 series in 2026. Assuming all goes well with testing, Samsung will reportedly be one of the first to bring the commercialized 2nm-based chip, following a likely 3nm chip arriving with the Galaxy S25 in 2025. (ET News, Android Central, GSM Arena)

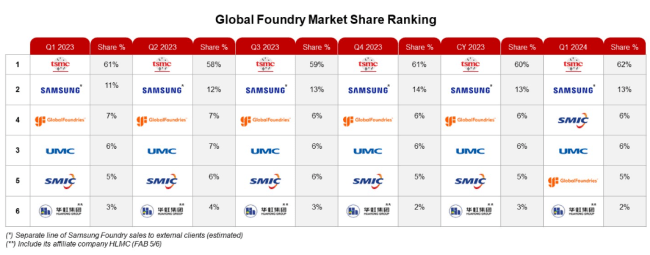

The global foundry industry’s revenue declined about 5% QoQ but grew 12% YoY in 1Q24, according to Counterpoint Research. The sequential decline in the industry revenue in 1Q24 was not solely due to seasonal effects. It was also impacted by a slower recovery in demand for non-AI semiconductors, spanning sectors such as smartphones, consumer electronics, IoT, automotive, and industrial applications. This trend resonates with the observations of TSMC’s management regarding the sluggish pace of recovery in non-AI demand. Consequently, TSMC has revised down the projected growth for the logic semiconductor industry from over 10% to 10% in 2024. (Android Headlines, Counterpoint Research)

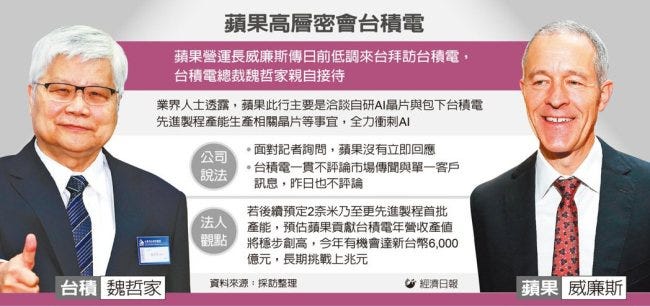

Apple COO Jeff Williams has allegedly visited Taiwan to meet with TSMC’s president CC Wei. The low-profile visit was made to secure TSMC’s advanced manufacturing capacity, potentially 2nm process, booked for Apple’s in-house AI-chips. Apple has been collaborating with TSMC for many years on the A-series processors used in iPhones. In recent years, Apple initiated the long-term Apple Silicon project, creating the M-series processors for MacBook and iPad, with Williams playing a key role. (Android Headlines, Android Authority, UDN, 9to5Mac, TrendForce)

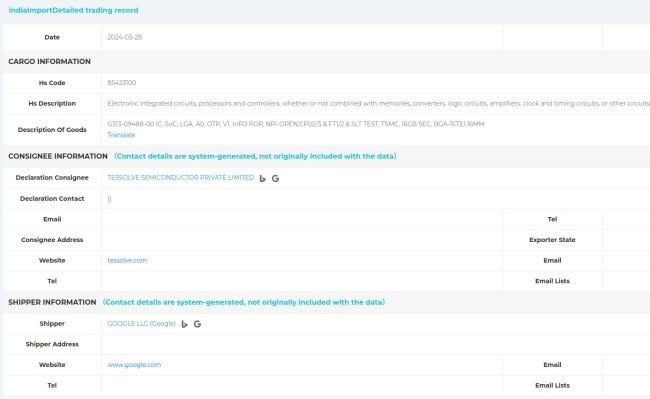

Google’s custom Tensor processors have been developed in close collaboration with Samsung’s foundry division since the first generation chip back in 2021. Google Tensor G5, which is believed to power Google Pixel 10, will allegedly be manufactured by TSMC, making it Google’s first chip made without Samsung. (Android Authority)

South Korea has announced a KRW26T (USD19B) support package for its chip businesses, citing a need to keep up in areas like chip design and contract manufacturing amid “all-out warfare” in the global semiconductor market. Under the package, President Yoon Suk Yeol said a financial support programme worth about KRW17T was planned through state-run Korea Development Bank to back investments by semiconductor companies, according to the presidential office. South Korea’s share of the global fabless sector, which is dominated by companies like U.S. giant Nvidia, opens new tab that design chips but outsource manufacturing, stood at about 1%, Yoon’s office said. There was also a gap between local chipmakers and the leading contract chip makers like Taiwan’s TSMC. Yoon said a KRW1T fund would be set up to support equipment makers and fabless companies. (WSJ,Engadget, Bloomberg, Reuters)

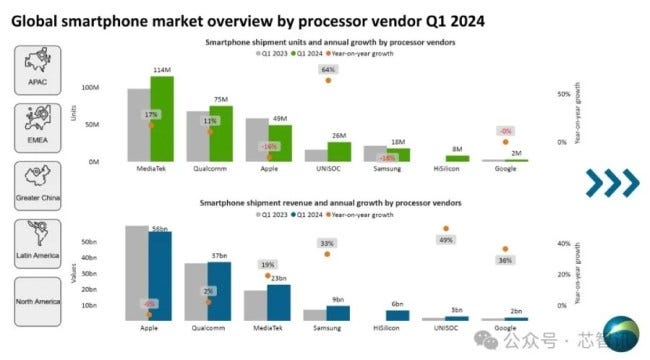

According to Canalys, Huawei shipped 8M Kirin units in 1Q24, generating USD6B in revenue. Canalys analytical data highlights that Huawei HiSilicon stands at the sixth rank in the 1Q24 global smartphone chip market. It scored 2.7% of the market share. Huawei has surpassed Google’s chipset shipments and revenue in 1Q24. Google only shipped 2M of its smartphone SoCs and generated USD2B in revenue from it. MediaTek has ranked first in this listing with 114M unit shipments, while Qualcomm is standing in second position with a shipment of 75M units. Both obtained 17 and 11% market share, respectively. (Huawei Central, MyDrivers, WCCFTech, Gizmo China)