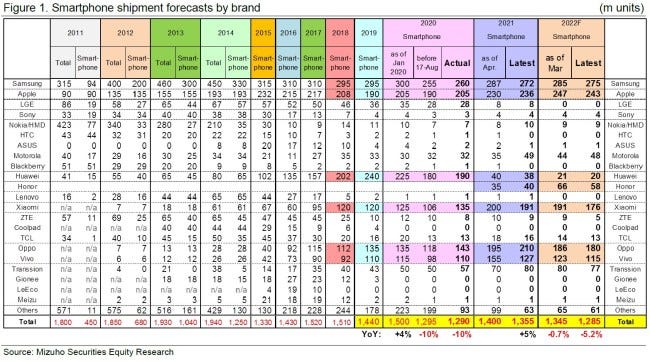

Global Mobile Market Decline by ~5% in 2022.

MizuhoSecurities maintains their fundamental view that momentum will be stronger for high-end smartphones than for middle- and low-end smartphones and stronger for Apple iOS devices than for Android devices. By brand, they still expect volume to exceed the 2021 levels for Apple (mainly high-end smartphones with emerging markets accounting for a small portion of business) and Samsung Electronics (high-end smartphones; benefits from built-in 4G SoC smartphones). However, they lower estimates slightly for low-end models, namely the iPhone SE and the Galaxy A-series from Samsung Electronics. Among Chinese phone makers, they expect Huawei and Honor to try and expand sales of high-end models in China and middle-range models overseas. They forecast particularly high growth for Honor. They estimate that shipment volume in 2023 will increase by around 6% for Xiaomi, OPPO, and vivo as a result of sales growth in emerging economies and the benefits of a domestic market recovery. (Mizuho Securities report)

Chinese smartphone makers are drastically toning down their strategies owing to waning demand within China and stalling demand in key export markets (Europe, Asia, South America). Consequently, Mizuho Securities thinks the backward correction will continue in 2022, starting with sell-through, then feeding back to shipments, production, and procurement. Once the inventory adjustment has progressed sufficiently, they expect production to recover from around Oct 2022, with procurement bottoming out around three months later depending on the specific parts and materials (the correction will likely take longer for semiconductors / commoditized components, where the shortage was less pronounced). For Samsung Electronics, Mizuho Securities expects the correction to hit midrange and lower rather than high-end models (such as the Galaxy S), with some constraint on parts procurement. (Mizuho Securities report)

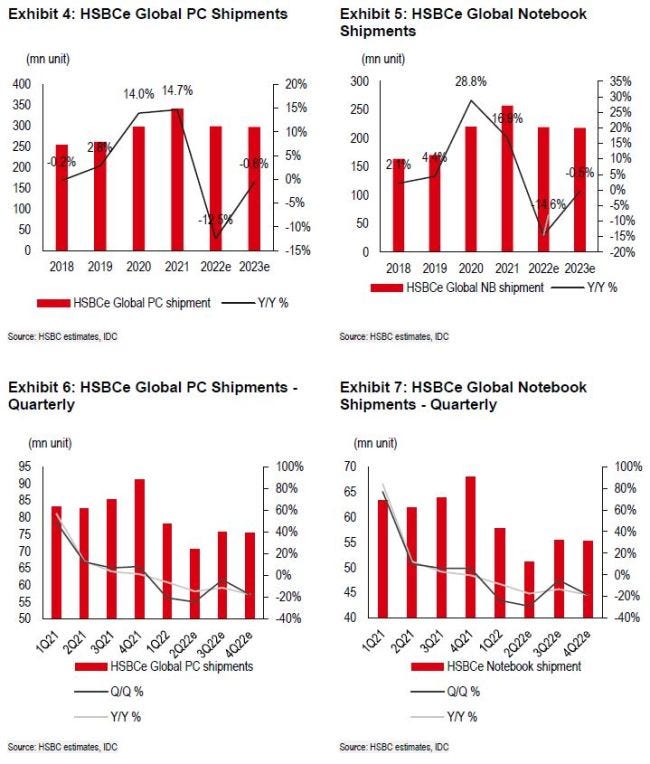

Global Notebook Market Decline by ~12% in 2022.

SBC Global Research now estimate 2Q22 global notebook (NB) shipments will decline 12% QoQ (compared to their previous forecast of up 6% QoQ), which will likely be the trough for global NB shipments in 2022e, owing to the production constraints due to China lock-downs, as well as tepid Chromebook and consumer demand. Looking forward, the production in Shanghai and Kunshan has been recovering since end-May 2022 and was back to a 90%+ utilization rate in June 2022. However, in-transit finished goods have been gradually arriving to the channels in 2Q22, post the logistics constraints, which has led to higher than normal inventory levels in channels (currently above 12 weeks vs. the normal level of 8–12 weeks). This implies downside risk for mainstream consumer notebook shipments due to the unclear demand visibility for 2H22. Thus, HSBC expects a weaker rebound and a more flattish seasonality than normal in 3Q22. Overall, HSBC forecasts a +8.3% QoQ increase in NB shipments in 3Q22, vs. the average QoQ increase of +12.6% during 2017–2019. (HSBC Research report)

HSBC further lower their 2022 global notebook shipment forecast from flat YoY to -15% YoY (vs. the latest IDC forecast of -8.6%) as they expect a tepid rebound in 2H22 due to overall demand uncertainty. Specifically, although HSBC still expects YoY growth for commercial and gaming models, HSBC are seeing slower enterprise spending and gaming demand growth. Thus, they lower their shipment forecasts for commercial/gaming models to +7% / +5% YoY in 2022e, vs. their previous forecasts of +16% / +10%. Furthermore, they cut forecasts for mainstream consumer / Chromebook shipments more significantly, to –23% / -59% YoY, vs. the previous -7% / -30% YoY in 2022, as they see weaker demand due to elevated pricing due to global inflation, and muted demand in Europe capped by the Russia-Ukraine war, coupled with inventory digestion due to the increasing levels of inventory in transit. (HSBC Research report)